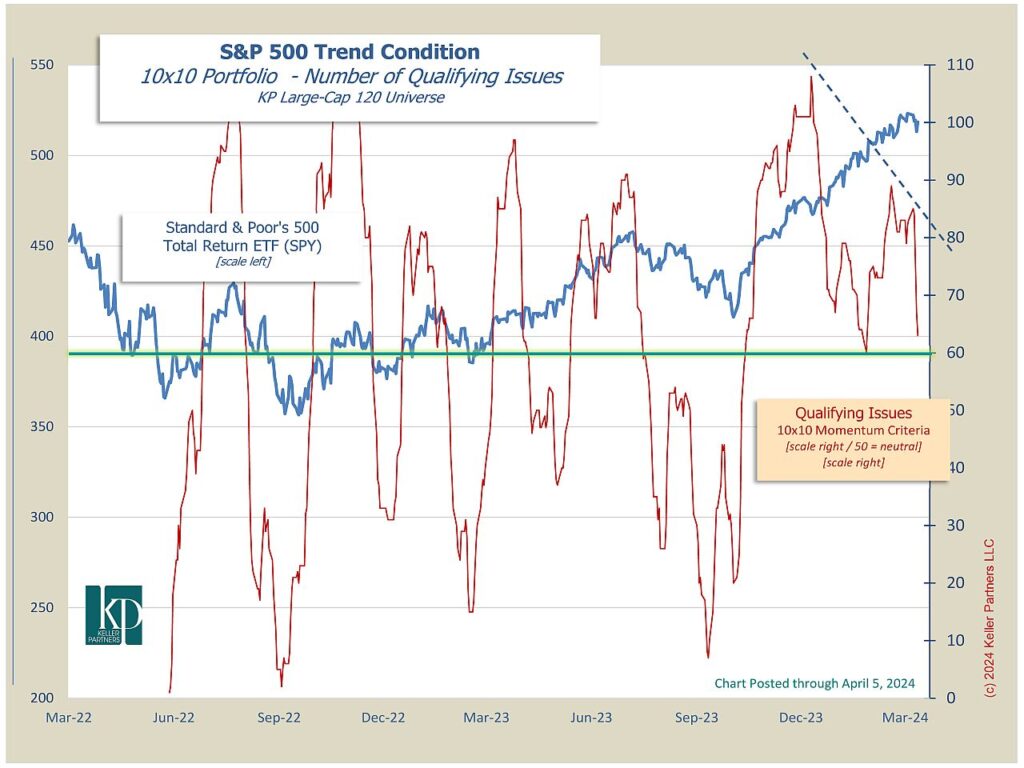

The Trend Model. Both elements of our trend modeling process remain Green. Full policy exposure to US equities.

From the Trading Room. Healthy equity markets are often said to be “broad,” meaning that most stocks are participating in the upward trend. As market advances mature, they are often described as “narrowing,” — fewer issues participating.

Narrowing conditions often precede important tops. Accordingly, we monitor market breadth in various ways to remain vigilant for upcoming changes in the trend models. This week, we present a two-year chart depicting the number of the large-cap stocks in our 120 large-cap universe are currently ranked “buy,” or eligible for purchase. When that number starts to decline, we have narrowing.

As we see, this qualifying number is very volatile — it has historically ranged from less than 10 issues to over 100. And it oscillates back and forth quite frequently, often without explanation. However, when the trend of that number is declining while markets continue to make new highs (as is now the case), that divergence is well worth watching.