The Model. Our KP Trend Model remains Green, suggesting maximum policy exposure US equities.

From the Trading Room. Over many decades, technical analysts have noted that important market tops tend to be preceded by a “thinning” of participation — a technical phenomenon where prices of the major indices — dominated by a small number of very large stocks — continue marching upward while many other more average stocks struggle to participate.

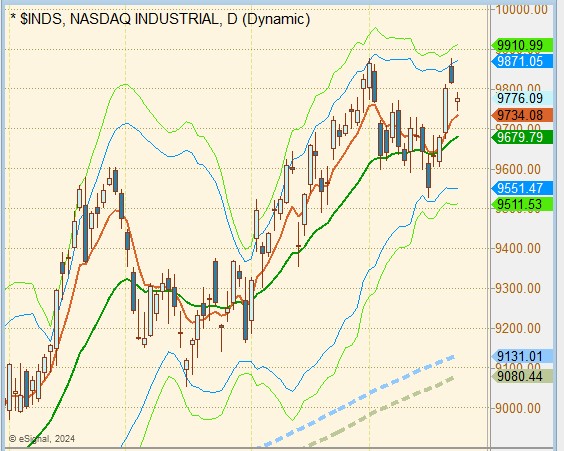

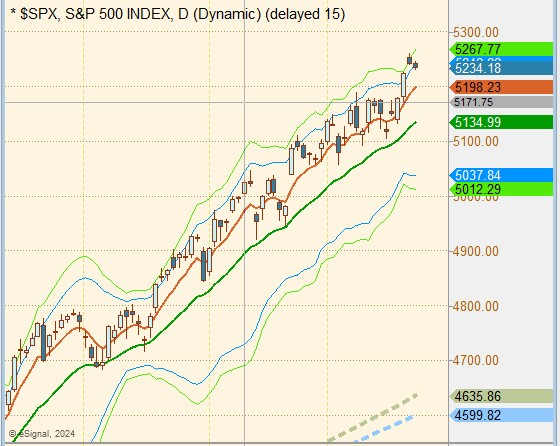

For example, a recent comparison of the Nasdaq Industrial Index ($INDS) and the S&P 500 ($SPX):

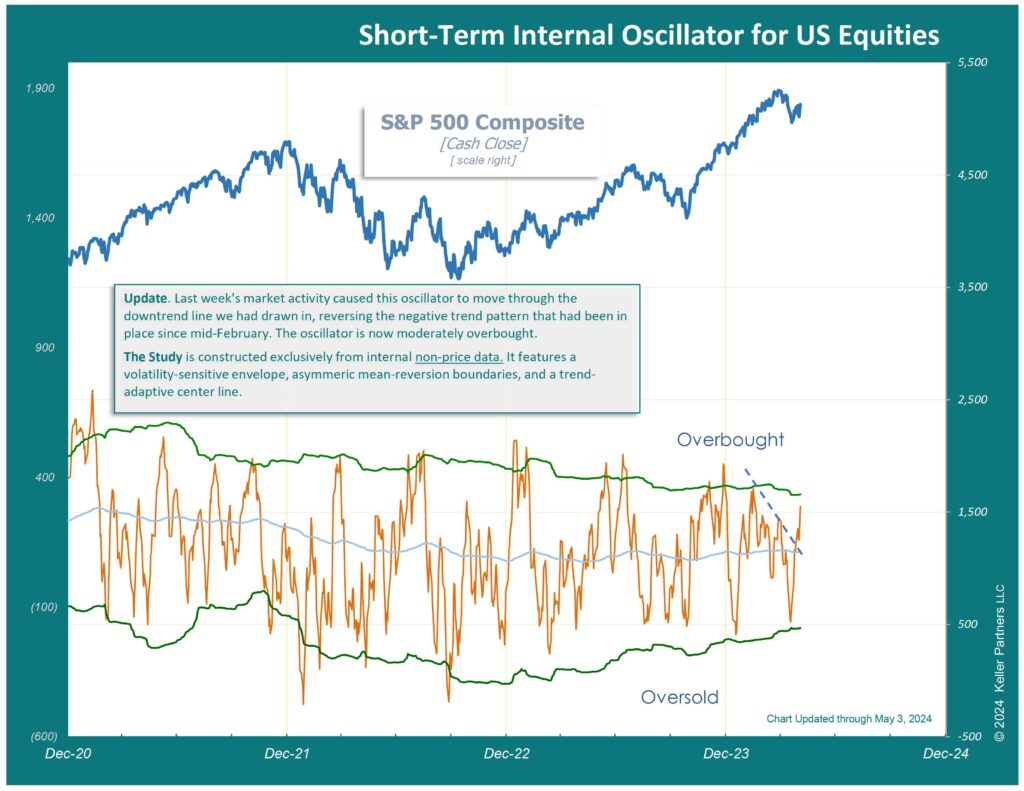

This kind of “thinning” has also begun to appear in our technical studies. Here is this week’s updated chart of our Short-Term Oscillator, a mean reversion tool based on internal market data, not on price. It shows considerable recent divergence with the S&P.

All of this suggests that the market’s underpinnings are not as strong as they were a few months ago. Still, the timing of what happens next is uncertain, and today is not necessarily time to reduce exposure. But it’s time to remain alert.

Our trend models are calibrated to filter much of the near term financial noise and they are deliberate in their reaction. However, they have a solid record of identifying major events in both directions. As we said at the outset, right now they remain positive.