Technical Factors

Factor investing is a key driver of investment management today. Yet, despite its conceptual appeal and widespread implementation, the approach has delivered mostly average results.

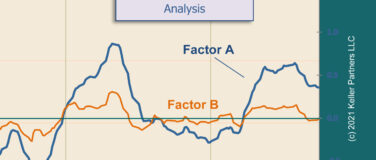

Keller Partners takes factor research in a different direction . . .

Status of the KP Trend Model

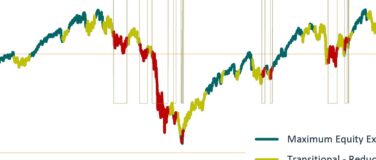

The performance of the stock market determines 70% – 80% of the performance of your self-directed retirement account. Success at managing your investments is mostly about managing the trend of the markets and just a little bit about fund choices or selection of individual investments.

Analyzing Market Trends

At the end of the day, market trends, not investment selections, dominate the performance of an investment portfolio.

Forecasting these trends is a challenging undertaking, but it is critical that an investment manager make the effort. Even a partially-successful approach to managing market risk is likely to significantly impact volatility and portfolio drawdown. Effective trend analysis efforts make a huge difference.