The Model. The Trend Model remains emphatically Green. Full policy commitment to US equities.

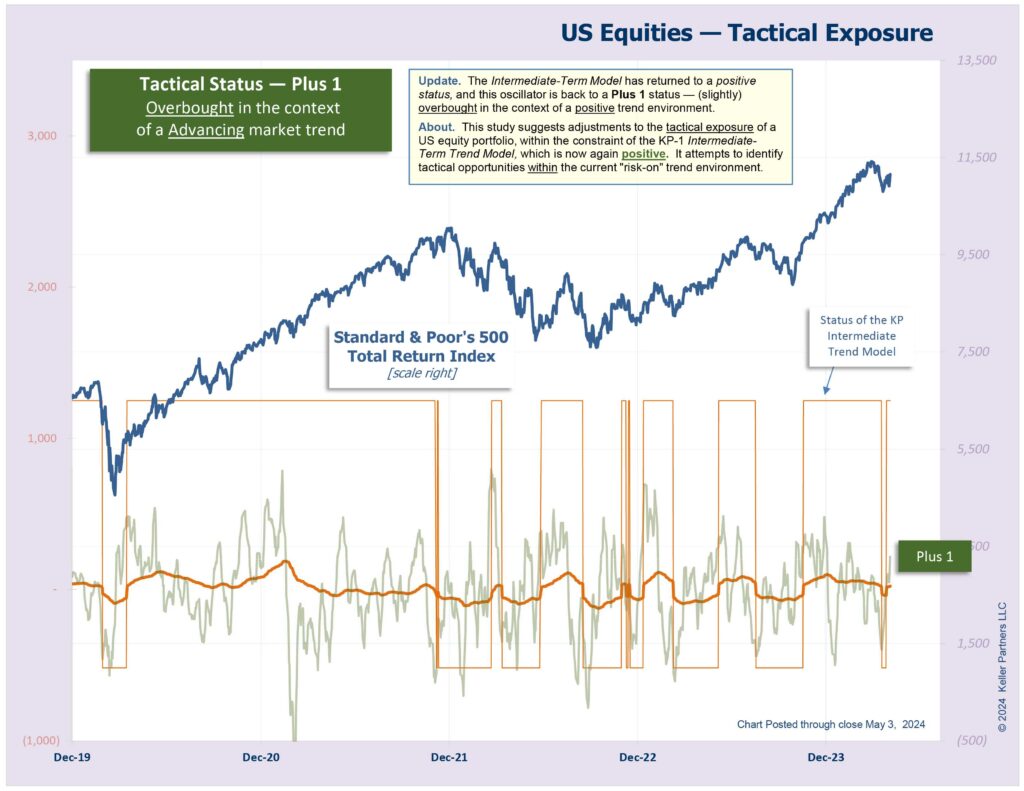

From the Trading Room. The Multi-Media Bar on the homepage of our website displays 14 charts, the last of which is titled US Equities — Tactical Exposure and it looks like this:

Here’s the reason behind this chart:

Even when we are in a well-defined rising trend, as we are now, the market still experiences short-term fluctuations — overbought and oversold conditions — within the context of the longer-term trend. This chart is designed to help portfolio managers with the timing of cash additions / withdrawals. The same dynamic applies in a declining trend.

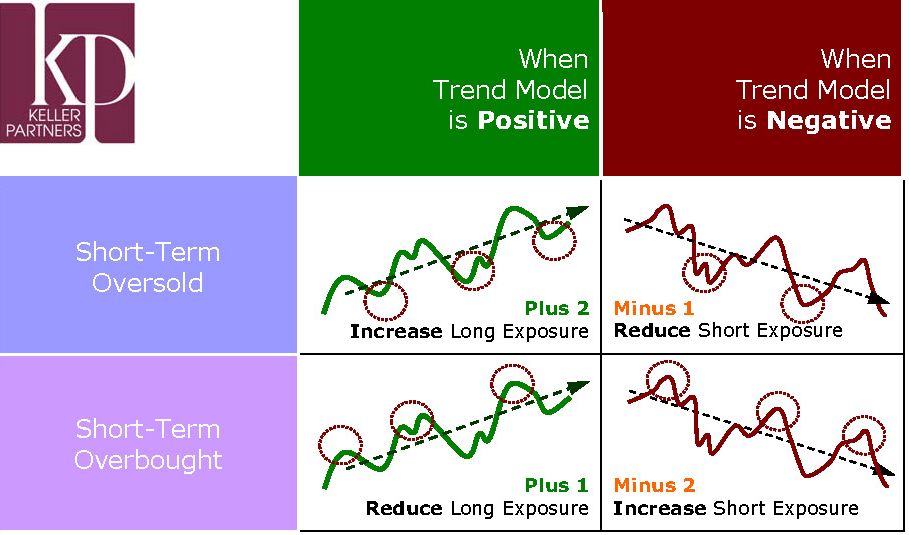

There are four possible conditions for this indicator: Plus 1, Plus 2 / Minus 1, Minus 2. Here’s what they look like conceptually:

Obviously, the real world is far from precise and very often we also find markets in a relatively balanced short-term position when mean-reversion tools such as this oscillator don’t add much value. Nevertheless, we report on the status of the four quadrants every week. Over time, they have added value.

Right now, the study is in a Plus 2 status, suggesting that market internals are slightly oversold within the context of a positive trend — usually a good time to add equity exposure.