Factor investing is a key driver of investment management today. Yet, despite its conceptual appeal and widespread implementation, the approach has delivered mostly average results.

Keller Partners takes factor research in a different direction . . .

Quick review: Factors are attributes of individual stocks believed to be associated with performance advantages — on average and over time. Many investment managers today believe that portfolios that focus on certain factors can and will deliver superior risk-adjusted returns. The most widely accepted and implemented of these factors are —

Momentum

Value

Quality (high is better)

Growth

Volatility (low is better)

Yield (dividends)

Size (smaller is better)

A large body of academic research supports factor-based investing, yet it has often disappointed in practice. There are several reasons for this:

[1] The excess (risk-adjusted) returns available to be “harvested” from factor investing were never that significant to begin with and have proven erratic (or have perhaps arbitraged away) over time. We have experienced multi-year periods where intuitively logical factors have underperformed significantly.

[2] Even more important — and critical from the perspective of the individual investor — there has never been a suggestion that factor emphasis protected a portfolio from significant drawdowns. Product design teams overlook the fact that individuals seldom survive large drawdowns.

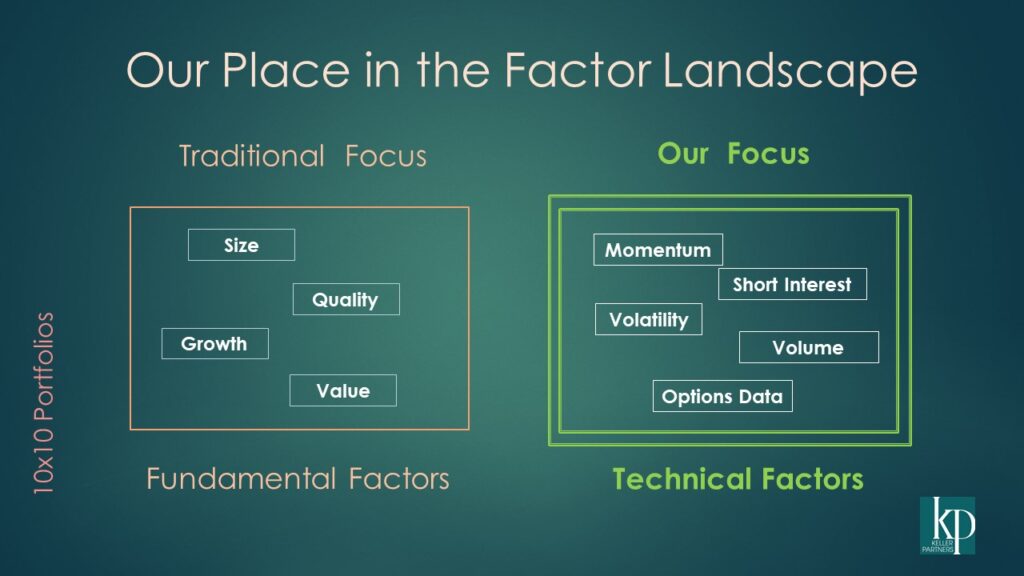

Keller Partners sees the factor landscape differently. We separate those widely-implemented fundamental factors above from another group of factors where the data come directly from the securities markets. We have found these market-driven time series to contribute substantial value to the investment process. We label them “technical factors.”

Fact Sheet: Technical Factors

As Benjamin Graham taught us, financial markets are “weighing machines.” In the long run, fundamentals matter very much — they are the only thing that matters. However, over shorter horizons of one, two or even three years, financial markets are instead “voting machines.” Here, fundamentals don’t explain very much of what actually determines investment returns on a quarter-to-quarter basis.

Our work is focused on the “voting machine” dynamic, and we exclusively use market information to formulate our conclusions.

With the exception of momentum, a widely documented and highly reliable factor that is calculated from market data (prices), the “technical factors” listed in the box on the right have received little professional attention. Meanwhile, the classic, fundamentally based factors on the left, have been widely analyzed and applied. The key difference is that fundamental factors examine statistical characteristics of companies. while technical factors look to the behavior of markets and securities.

At Keller Partners the analysis of technical factors supports two investment management activities:

[1] Investment Selection / Portfolio Construction. A daily quantitative process analyzes individual securities (or exchange traded funds) for performance potential over a 6–18-month time horizon, identifying securities that (our analysis believes) may significantly outperform — or underperform — popular benchmarks. Since the approach is driven by market information rather than fundamental information, portfolio adjustments are prompted by what markets are doing, rather than we believe they should be doing. Simply, our approach attempts to follow the money.

Portfolios informed by this performance evaluation process tend to deliver long-term return patterns at least in line with the benchmark, but with significantly less volatility and drawdown. Our goal is to generate higher risk-adjusted metrics (Sharpe / Sortino Ratios) than passive index investments.

[2] Market Trend Analysis. Separately, Keller Partners maintains several technically-informed market trend models which seek to identify the current trend regime for US equity markets. The KP Market Trend Model suggests changes of equity exposure roughly six times a year, and we report on its status weekly on this website. A shorter-horizon model, the KP Intermediate-Term Model generates long/cash signals for major US index ETFs.